The VAT Rate(s) Applied on the Invoice in the United Kingdom

The VAT rate is the percentage applicable to the value of goods sold. It is a consumer tax and is therefore applied to the value of goods sold. The primary mechanism of the application or calculation of VAT:

Price inclusive of VAT = Price exclusive of VAT * (100 + VAT rate) / 100

Price exclusive of VAT = Price inclusive of VAT / (100 + VAT rate) * 100

VAT rate = (Price inclusive of VAT / Price exclusive of VAT - 1) * 100

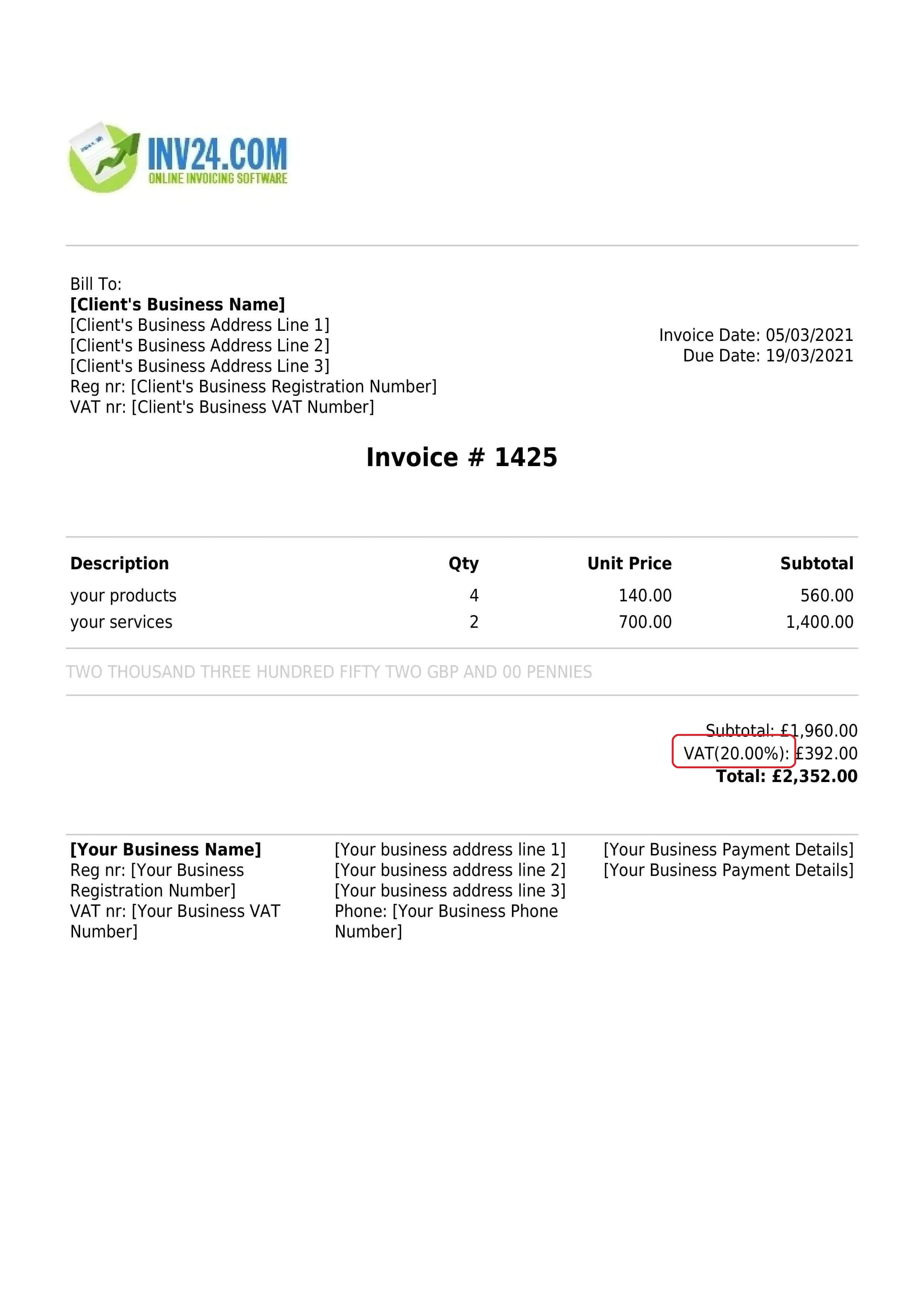

There is a 20% standard VAT rate in UK, however some categories of products or services may have reduced VAT rates or to be exempt from VAT.

Invoicing tools for UK: