Credit Note in the United Kingdom

- What is a credit note?

- Credit note sample

- When to issue a credit note

- How to create a credit note

- Does a credit note reduce the VAT amount that a seller has already paid?

What is a credit note?

A credit note, also known as a credit invoice, is a minus invoice that reduces the total amount to be paid. Also known as a negative invoice, a credit note notifies the client or buyer that they no longer have to pay the original total due amount. The total amount is reduced by the amount of the credit note. In situations where the total amount due is the same as the amount on the credit note, then this would cancel out the entire invoice. On the other hand, the credit note could also be for less than the total invoice amount due.

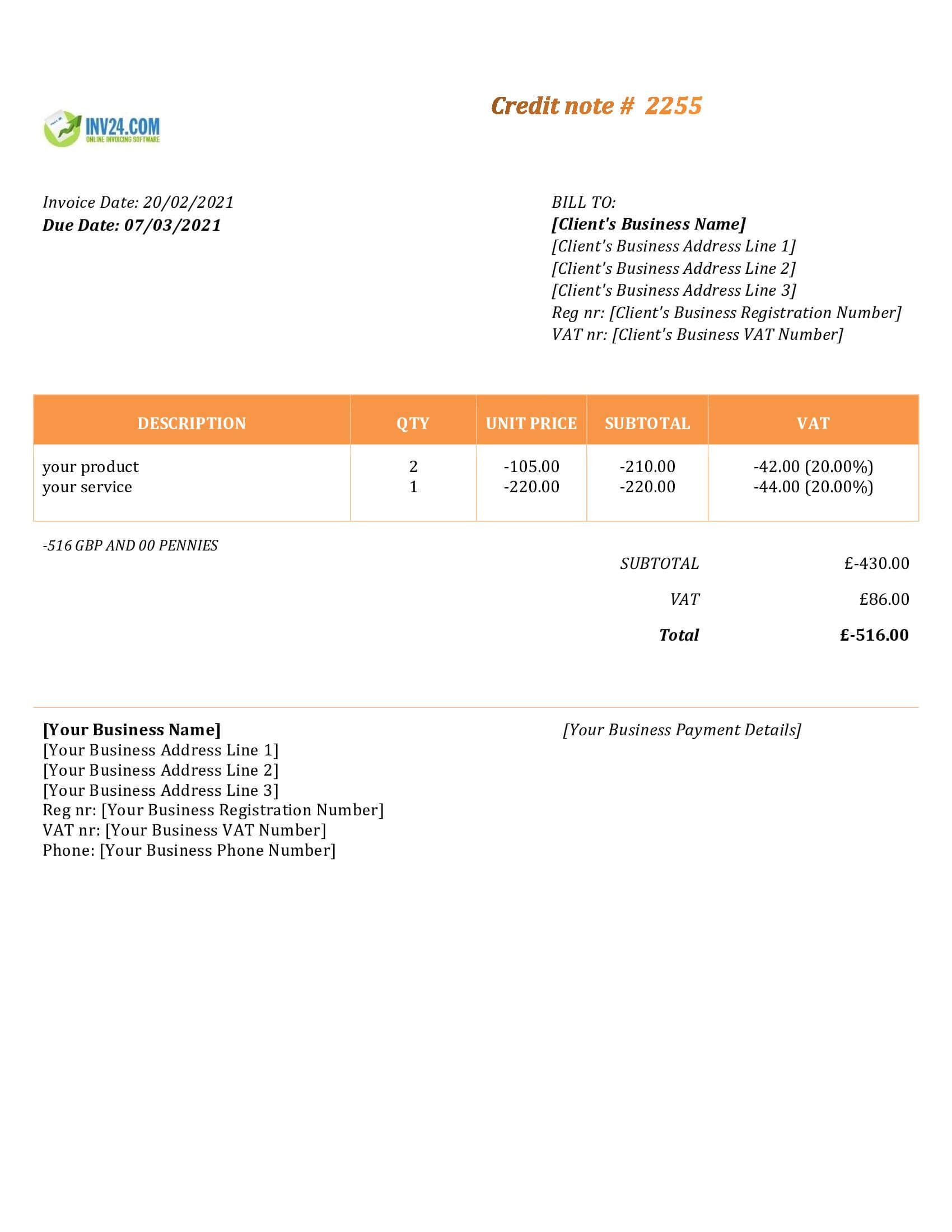

When creating a credit note for your customer, there are several important details to be included. Namely, the quantity of the product, type of product and the amount reduced from the original agreed price. Essentially, the credit note references the original sent invoice and is a typically straightforward document to create. It may even mention the reason for the reduction in amount to be paid.

The use of credit notes are a great way to handle any mistakes that are made in invoice creation. They can serve as a way to mend the relationship between seller and buyer in situations where damaged goods were sent or errors were made in pricing.

Credit note sample

When to issue a credit note

A credit note is issued when an invoice is already sent, but for some reason, the delivered products or services are not complete or may be damaged. Due to this incomplete delivery or damaged product, the seller agrees to partly reduce the original price and a credit note is therefore sent to the customer.

If an invoice has already paid, the subtracted amount from the total needs to be returned to the customer in cash, wire bank transfer or any other payment method. Please note that a credit note can only be sent by the seller to the buyer and not vice versa.

A credit note can also be issued and provided if the customer has been unknowingly charged extra, or if the wrong invoice has been sent. In addition, if the customer or client is not satisfied with the delivered product or service, then a credit note can also be a tool to use to offer a full or partial refund to the customer.

Another situation in which a credit note can be issued is when an invoice has been sent out to the customer before a discount has been agreed upon. In order to allow the customer to pay the reduced amount, a credit note can be issued for the agreed discounted amount.

Lastly, another situation where a credit note can be used is when a customer accidentally overpays the seller. This extra cash, in the form of a credit note is applied to the customer’s next purchase. Or it can be transferred back. In this case, it is not a reduction in the amount due. In order to keep accurate records, it is recommended that you record the overpayment when doing your accounting.

How to create a credit note

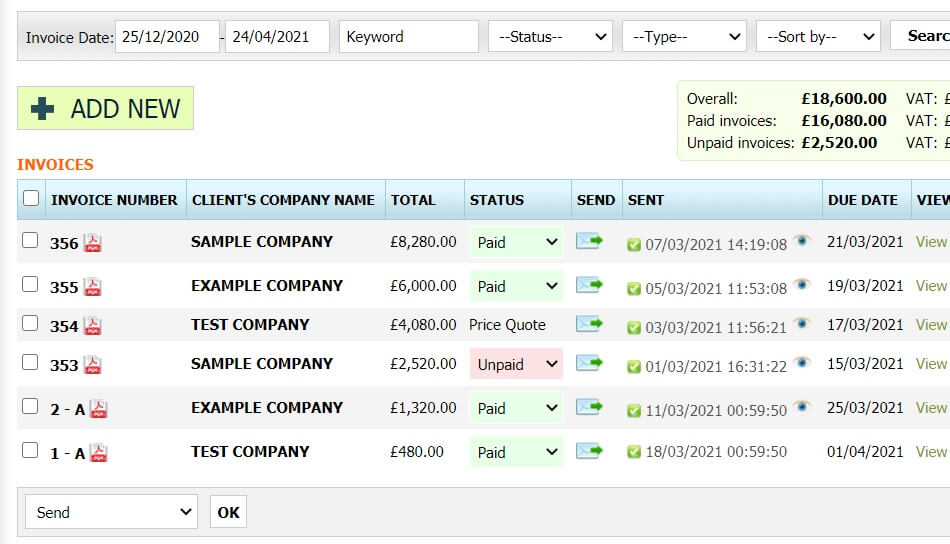

Method 1: Use our simple invoice software for the United Kingdom

- Try It Free

- When you add invoice, set invoice type to “Credit note”

- You can copy and convert an invoice into a credit note in just a few clicks

-

Method 2: Download a free credit note template for the United Kingdom:

Does a credit note reduce the VAT amount that a seller has already paid?

Yes, it does. However, your accountant will have to declare it and the seller will be able to pay less VAT in the following month. Credit notes are recorded in your accounting records to show that a stated amount was given back to a customer.

Now that you know how credit notes are sent and how they are used, then we recommend that you make and send professional credit notes by using our superior invoice software for the United Kingdom. It is efficient and will save you time, while increasing your productivity. You will have the ability to send credit notes quickly and smoothly by using our services!

Sample Email Template for a Credit Note

Hello {Name of the customer},

I am pleased to communicate that we have adjusted your balance in our books on account of returns made on {DATE}. The amount {AAA} has been adjusted against invoice # {YYY} dated {DATE}.

Please see the attached credit note and inform us if you have any questions or queries.

Further, we apologize for any inconvenience caused in the order fulfilment process. We look forward to continually serve with higher passion and devotion.

Best regards,

{Your name}

{Your position in the company}

{Your company name}

{Your contact details}

Other types of invoices for UK:

- VAT Invoice: standard invoice issued by a VAT payer

- Invoice for VAT non-payer: standard invoice issued by a VAT non-payer company

- Proforma invoice: simple request for payment

- Recurring invoice: automatic invoicing a subscribing customer

- Price quote: price offer of a fixed price for specific goods or services

- Debit note: requesting a refund from a vendor