Invoice for VAT non-payer in UK

- What is an invoice for VAT non-payer

- Invoice sample for VAT non-payer company

- How to create an invoice for a VAT non payer company

What is an invoice for VAT non-payer

An invoice for VAT non-payer is a standard sales invoice issued by a seller company that is not registered for VAT in the United Kingdom. These businesses do not have VAT number and do not pay VAT to tax authorities, therefore cannot add VAT to their invoices.

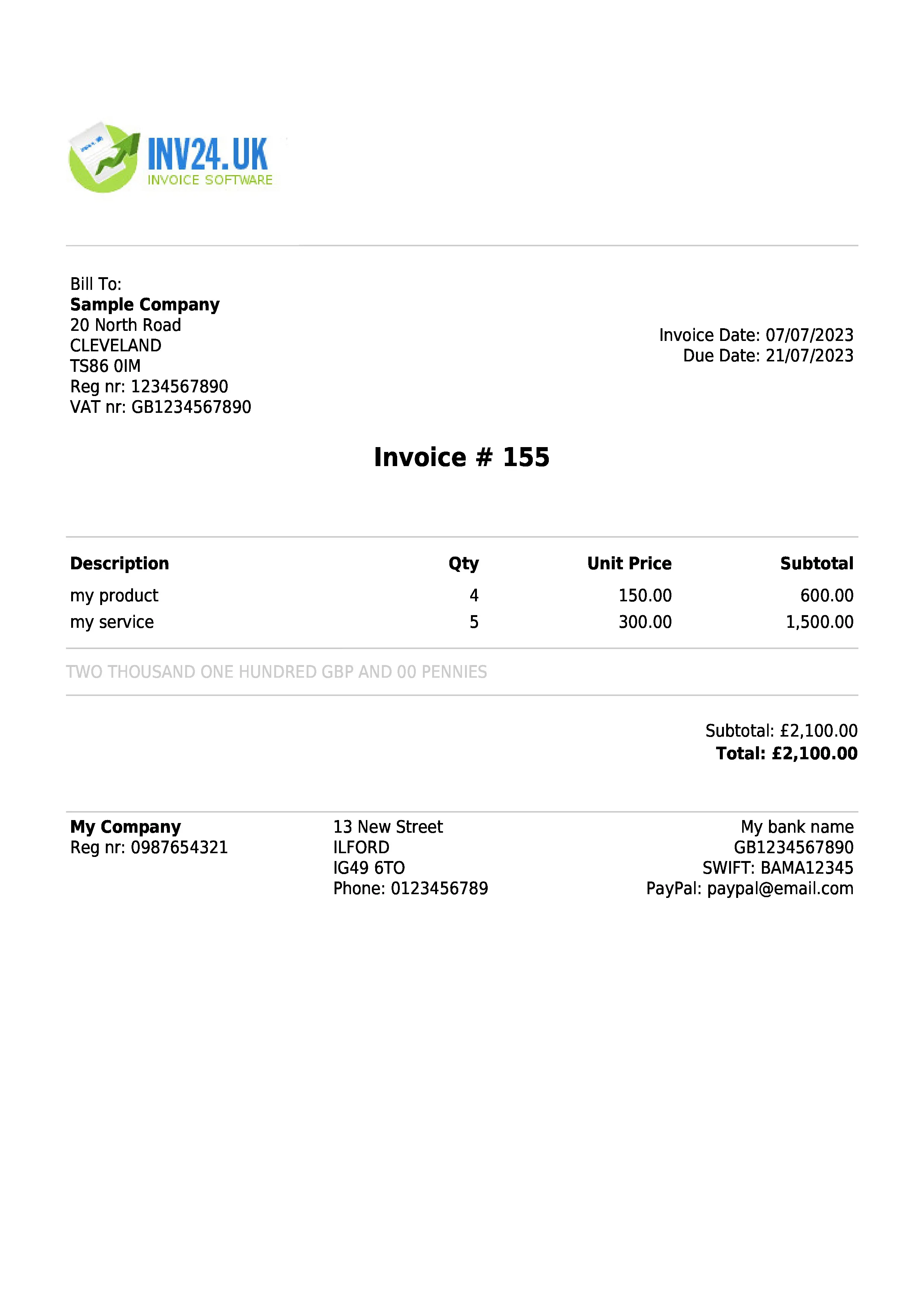

Invoice sample for VAT non-payer company

How to create an invoice for a VAT non payer company

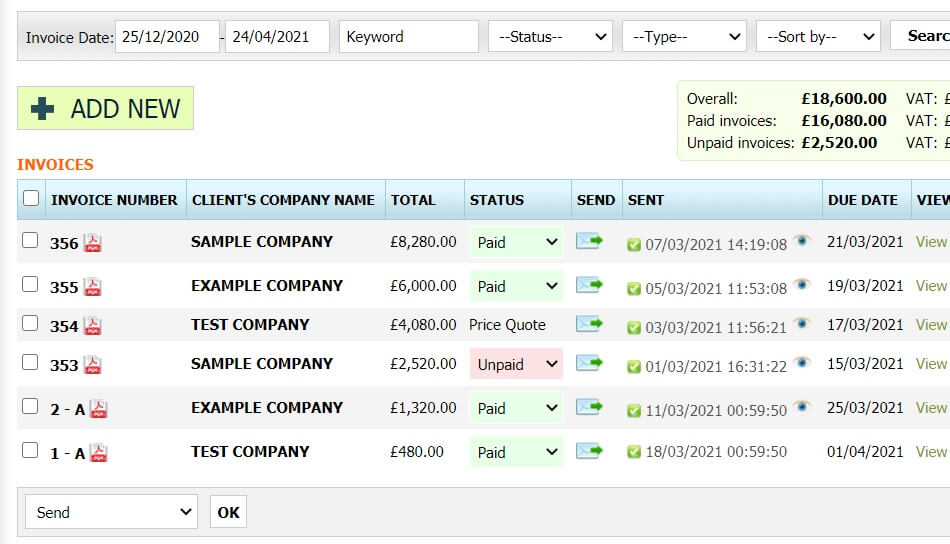

Method 1: Use our simple invoice software for the United Kingdom

- Try It Free

- Set “VAT rate” to “0”

- Keep the “VAT number” input field blank

-

Method 2: Download a free editable invoice template for the United Kingdom (leave the VAT fields blank)

Other types of invoices for UK:

- VAT Invoice: standard invoice issued by a VAT payer

- Proforma invoice: simple request for payment

- Credit note: refunding a customer

- Recurring invoice: automatic invoicing a subscribing customer

- Price quote: price offer of a fixed price for specific goods or services

- Debit note: requesting a refund from a vendor